Established in 2015 with just a handful of people, EnerQuip can be rightfully proud of its achievements over its short existence, which started in the middle of a global recession and continued through a global pandemic. Having withstood the challenges of recent years, EnerQuip is set to achieve 50% year-on-year growth in 2023.

In 2019, Business Focus interviewed Managing Director Andrew Robins who spoke about the company’s beginnings and how the then challenges were turned into opportunities for the Aberdeen-based company. Four years later, the company continues to stand strong.

“Demand is increasing,” says Robins. “The oil and gas sector has experienced chronic underinvestment since the global crash in 2014, further prolonged by Covid-19, and we are now benefitting from that gap. The sector revival has been further accentuated by the war in Ukraine, which has sharpened everyone’s focus, that of the UK government included, on the fact that energy independence is vitally important.”

“Given recent political developments, the world is looking at different paths to meet its energy needs,” reflects Darren Bragg, Head of Sales – Global. “The ‘energy transition’ that’s been discussed in the last few years has been discovered to not be fit for purpose, yet. The events in Europe across last winter with gas preservation and energy saving initiatives demonstrate the vital part oil and gas still has in our lives and society. Today, it’s more like an energy jigsaw, where we need energy of all sources, and oil and gas is at the centre of that, and the picture isn’t complete without all the pieces.”

Expertise in a niche market

Expertise in a niche market

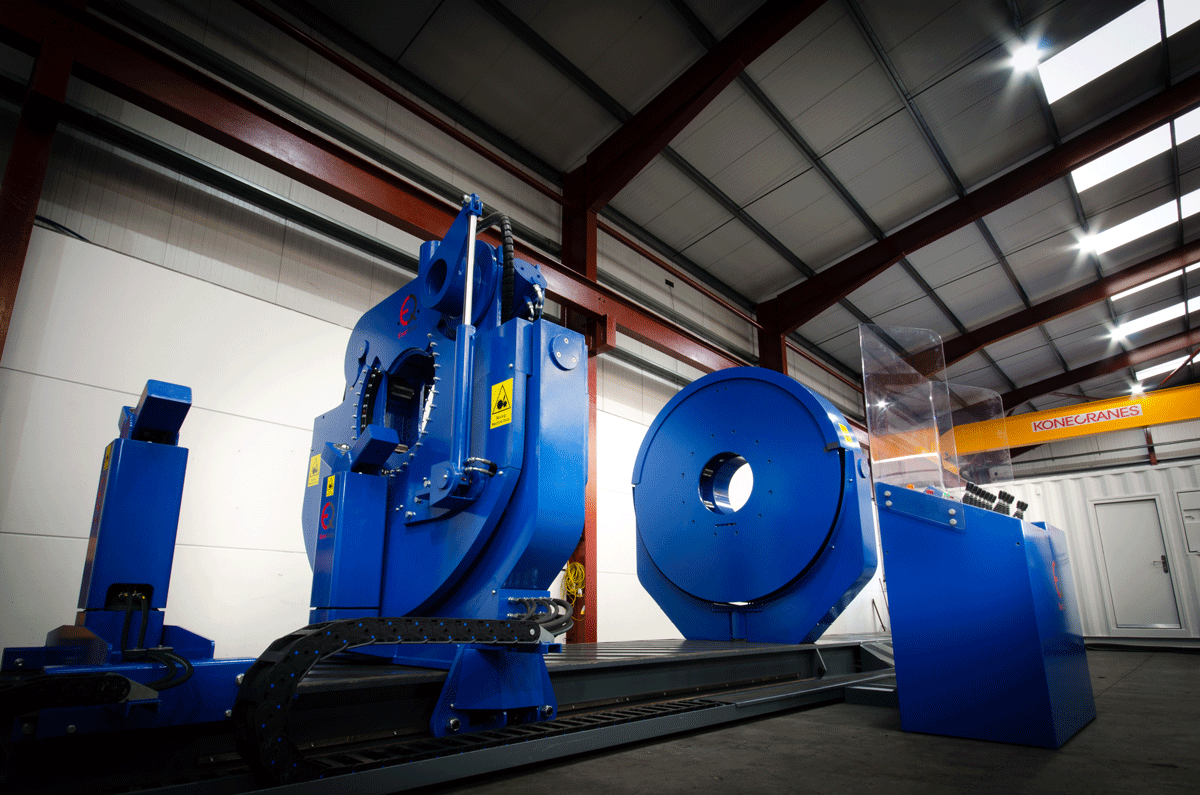

EnerQuip specialises in the design, manufacture, installation and maintenance of torque machines and associated products, includ-ing bucking units and fully rotational makeup and breakout torque machines which can be adapted to suit any application.

EnerQuip’s flagship solution is the Mobile Torque Unit (MTU), designed to improve rig site efficiency, improve manual handling operations whilst reducing carbon emissions and costs. The system, requiring only one operator, is capable of making up casing range 3 doubles and drill pipe triples automatically and delivering an output of up to 20 casing doubles an hour. “This output can deliver as much as a 45% rig time saving over conventional operations. Shortening the time of a well completing has obviously significant environmental benefits.”

Bragg affirms that in terms of diversification into sustainability, EnerQuip is always looking at how its skill sets can be repurposed and utilised. “We’ve been engaged recently with some of the project leaders in Scotwind, which aims to secure 60% domestic supply chain. We want to offer our services as a part of that.”

The company’s service offering includes the manufacture and/or upgrade of torque equipment from concept and design through to installation and commiss-ioning, servicing, calibration, repair and maintenance, training, and consultancy.

In our last interview, Andrew Robins states that collectively the company has over 100 years of experience with its products, and the knowledge and know-how of the team remain an important differentiator.

Expanded capability

EnerQuip has not only survived but has grown in the challenging market environment of the last few years. In the summer of 2022, its portfolio was significantly expanded with the acquisition of the AMC product line from Forum Energy Technologies, a major step towards further growing EnerQuip’s global presence.

Commenting on the deal, Robins says: “We are delighted to acquire such a prestigious and reputable industry brand and this product line acquisition will only serve to further bolster our growth aspirations. Our single most important goal is to ensure continuity of service to all and, by increasing our headcount globally, we have ensured we are well placed to maintain the elevated levels of satisfaction expected by all customers.”

Later in 2022, the company further enhanced its capability by purchasing Fife sub-contract precision machining company Diamac Engineering Ltd.

This was again a significant move, bringing machining capability for the group in-house, and opening up diversification opportunities thanks to Diamac’s established reputation across a range of sectors.

Meanwhile, an ongoing drive to further grow the company’s global presence included the recent establishment of a permanent presence in Australia in 2022, followed by the opening of an office in Abu Dhabi in 2023, in line with anticipated growth opportunities in the Middle East.

Global demand

Global demand

Setting up in Abu Dhabi has been a strategic move, as the Middle East region is expected to deliver 50% of EnerQuip’s revenues within the next few years, says Bragg. “Recruiting and getting the right people will be very important. Unlike other places around the world, the oil and gas sector has remained a key driver in the Middle East, with stability for the drilling activity and everything that goes with it. That’s our area of focus.”

“We will continue to invest in the Middle East, potentially considering manufacturing facilities in Abu Dhabi,” says Robins, adding that back in Scotland, the company is currently making an investment of £600,000 in another workshop, in order to boost capacity at its Aberdeen manufacturing headquarters.

Recent months have seen growing demand for products which include a range of torque machines and bucking units. Last year, EnerQuip secured more than $15 million in contracts around the globe with demand continuing to increase. “This is not limited to a single region. We are selling equipment to Germany, Italy, and other countries in Europe, as well as to the Middle East and the Americas. Approximately 98% of this years revenue come from international markets” says Robins.

“We have set up an ambitious ‘25 by 25’ Plan, meaning $25 million revenue by 2025,” says Bragg, adding that there’s a very good chance that the company will get pretty close to this target this year. “Being nearly two years ahead of schedule is nice but at the same time, we need to be realistic about the market being there to support it. Investments in the right places geographically will be important in allowing us to deliver.”

Speaking about the future, Robins admits that the company is often approached with opportunities for further acquisitions, particularly those labelled as being green or eco-friendly. “There’s a clamour for us to not just be an oil and gas, pure play, which we are today. But we’re not going to rush out and gobble something up because it’s got a green leaf on it. It does make sense to diversify, but we’re going to take our time and consider all options.”