Proseat is a recognised partner to the automotive industry, producing up to 300,000 parts per day for leading auto makers. Established in 2004, the company is headquartered in Germany and operates six production facilities across five European countries, supported by two customer service centres. Since 2022, Proseat has been fully owned by Sekisui, a leading Japanese specialist in lightweight materials development.

The company’s product range is divided into three business lines – foam parts (polyurethane formulations applied in car seats); trim parts (headrests, armrests and side bolsters); and lightweight parts of particle and PU foam, with an increasing focus on battery electric vehicles (BEV).

Restructured for a new course

Restructured for a new course

Proseat is now undergoing a process of business transformation under the leadership of its current CEO and President Sven Kunath, who assumed his role in January 2023. “I was brought in to turn the company around, restructure the business and give it a new direction. Preliminary results indicate that from 2025 towards the company will be back in the black.”

He acknowledges that the restructuring affects all aspects of the business including suppliers and customers, and aims at making the business resilient, ready to accommodate the needs of the automotive industry of the future.

“Achieving a culture change, a change in people’s mindset, is one of the biggest challenges.”

“The last few years have been a very hard time for many companies, and we are still seeing a lot of M&As as well as business closures in the automotive landscape. The OEMs managed to survive the challenges well by transferring price increases to the final customer, but the supply chain did not always have that luxury,” he notes.

Recent market developments have made each company look closely at its supplier base and Proseat is no exception. “When reducing CO2, the supply chain is a critical element. So, the whole automotive industry is looking at consolidating the supplier base, moving it closer to its manufacturing facilities. But of course, for some highly manual tasks such as sewing operation we still use suppliers further afield to stay cost competitive.”

The right expertise

Proseat is one of Europe’s largest independent manufacturers and suppliers of polyurethane foam technologies and seating, as well as interior components designed to enhance passenger comfort, functionality and safety. The company works with the world’s largest OEMs and Tier1 suppliers, including Volkswagen, BMW Group, Renault, Daimler, Stellantis, Ford and more. Two third of 2024 sales is for VW Group.

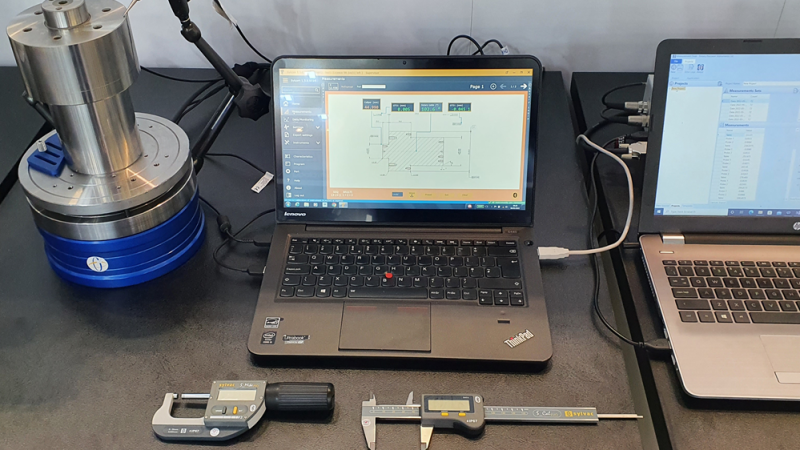

Proseat’s engineers and materials experts support customers from the original idea and concept through to serial production and beyond. Its interior solutions include ergonomic and functional headrests and armrests, high-quality side bolsters and lightweight parts that are low-emission and highly recyclable. Cutting-edge technology is used to convert various materials into products that add comfort to car interiors.

Proseat is now also focusing on the EV battery business, a segment with substantial growth potential – as reported by the International Energy Agency, increasing EV sales continue driving up global battery demand, reaching more than 750 GWh in 2023, up 40% relative to 2022.

“We have gone into product development with premium German OEMs in this area. There are many requirements for EV battery packs but with our capabilities and our expertise we are very well equipped for this business,” says Kunath, adding that despite the current slow-down in EV development as the gap between expectations and reality widens, the future still looks promising.

Greener automotive

Greener automotive

“Once major issues, such as the high cost of electric vehicles, insufficient infrastructure and limited driving range, are resolved, life will be very different. At the moment, the approach of leading OEMs, such as Toyota and BMW, is making sure their production lines are hybrid, i.e. are capable of assembling any type of car whether electric or with a combustion engine. They want to stay flexible, at least for the foreseeable future.”

Flexibility is also one of Proseat’s strengths. “Our advantage is that our products are applicable to any type of car. Drivers need to sit in a comfortable environment whether they drive an electric or a combustion engine car.”

To tackle the sustainability challenge, PUR industry is actively refining its approach to CO2 impact and sustainability in raw material production, prioritizing a mass balancing concept that integrates recycling and

bio-based sources. Through a revised production concept, the goal is to substantially increase recycling content and achieve significant improvements in cradle-to-gate CO2 reductions.

Kunath confirms Proseat’s commitment to embracing this emerging industry standard as part of the EuroMolders community. This initiative aligns with Proseat’s strategy to maximize the utilization of green energies and recycled raw materials, representing a pivotal advancement towards a more sustainable product portfolio.

The company has increased its focus on the development of environmentally friendly products and CO2 reduction, although the fact that its products reduce the weight and increase the longevity of automotive parts is environmentally friendly in its own right.

New opportunities

While Europe continues to be Proseat’s largest market, the company is now looking further afield to support its major customers. “Once the business restructuring is completed and solid foundations are in place, we will consider expanding our geographical reach, specifically in the EV battery segment,” says Kunath.

“For example, some German premium OEMs would ask us to cover their needs not only in Europe but also in their overseas markets, and we have also recorded interest from new customers. The decision on whether we will approach these markets on our own or in the form of a strategic partnership, such as an M&A or a joint venture, still remains to be taken.”

He further reflects that, generally speaking, currently there is enough capacity in the market for most products in Europe’s automotive industry, which still has not reached pre-Covid levels, but the capacity is not necessarily at the right place. To this end, the company is closely looking at re-balancing production across its sites and optimise its capacity

Sven Kunath shows a clear determination to progress towards his vision. “While I have set a new direction for the business, I am now leveraging everybody else to keep helping me steer the progress. The key objective is to increase profitability. Then you can start planning down the road. We do see new opportunities and that’s where we would like to spend our next investment. I could envisage the company growing by at least 30% over the next five years. But the baseline needs to be fixed first.”