Barnes Aerospace is a $1 billion global aerospace business. Part of Barnes, they focus on the manufacture and repair of aerospace propulsion components across their whole lifecycle, from parts for new engines, to spare parts for the aftermarket and turbine engine components repair and overhaul. The company has 1.5 million square feet of facilities, including its manufacturing and aftermarket business, across 15 sites in North America, Europe and Asia employing approximately 2,800 people.

“We have a dedicated and niche focus on the aero engine market with OEM and aftermarket capabilities, which is a unique offering at our scale,” says Ian Reason, President of Barnes Aerospace. “It allows us to offer our customers life-of-program solutions, adding value all the way across the lifecycle.”

That breadth of service means that at a time when there has been market and platform diversification across all the major OEMs, Barnes Aerospace is positioned to support any combination of new aircraft entering service. But as the market is expanding, so must the company.

“Just more than a year ago we set up a clear strategy to scale Barnes Aerospace,” Reason tells us. “We made a conscious decision to scale the business, and to do that it was important to have a strategy in place.”

Growth from the Core

The first step in that growth strategy was the largest acquisition in the firm’s history. Barnes Aerospace acquired MB Aerospace in a $740 million deal that doubled the size of the business. MB Aerospace would go on to be fully integrated into its new parent company, and very quickly become a single business.

“It expanded our footprint, leading us to become a truly global business and increasing diversification across our customers, markets and platforms,” Reason says.

While that might seem like a radical first step, Reason makes it clear that this was a careful and managed process.

“The important thing is that we are scaling from our core market,” Reason tells us. “We are an engine component-focused business and that is what we intend to scale ourselves. What we are doing is creating synergies as well as scale. We are growing our capabilities in our core market, giving our customers enhanced value and improved solutions.”

The global supply chain has changed dramatically since the advent of the Covid pandemic, and through this expansion Barnes Aerospace is able to act as a strategic supplier, going broader and deeper than its competitors.

Investing in Automation & People

Investing in Automation & People

Another part of that growth strategy is to leverage technology to do more with less, particularly through investment in automation technologies to free up human workers to do the jobs that only humans can.

“We are automating as many processes as we can, particularly repeatable processes. We are working to take away manual jobs to free up our labour to perform more value-adding tasks as we grow the business,” Reason explains.

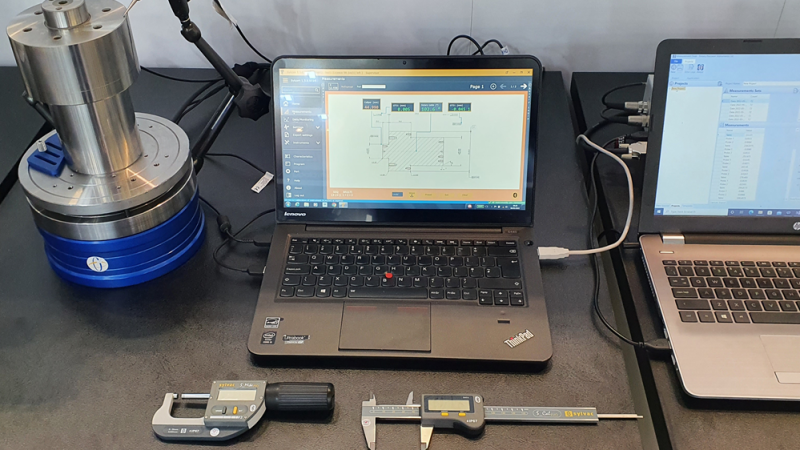

One example of this kind of automation is the EDM, or electric discharge machine that Barnes Aerospace has introduced to fully automate part of its manufacturing processes, which includes automatic part loading and the manufacture of the required electrodes.

“We are investing in helping our employees with labour-intensive tasks that are not only unexciting but also help to address health and safety issues such as repetitive strain injury,” Reason says. “It is about taking variability out of manual processes and freeing up labour that is becoming harder to get and retain in the current market.”

Reason is also excited about the possibilities of AI and machine learning. He tells us Barnes Aerospace is currently trialling two AI applications related to H&S risk assessments and high-volume parts inspections.

But while even at these early stages the possibilities of AI are exciting, Reason is under no illusions about the importance of Barnes Aerospace’s human capital.

“There is no doubt that the most important assets we have are our people and things have changed significantly in that area,” Reason says. “We have put a real focus on making Barnes Aerospace a great place to work so that people want to join us and want to stay. We have invested and focused on our total rewards package so that it is competitive with local markets. We want to be seen to be better than the alternative, but also to be a great place to work where employees feel valued and want to continue their careers. I would say we are in a war for talent, and it is a war I believe we are winning.”

Reason tells us that Barnes Aerospace has been engaged in significant training processes and investments to fill the workforce gaps caused by the pandemic.

“We had a lot of newer employees, some without an aerospace or manufacturing background, so we had to make a higher investment in training to bring our labour force up to the standards we need,” Reason says.

Recovery and Beyond

Recovery and Beyond

As well as the challenges on the human resources side of the sector, there are also continuing challenges from a supply chain point of view, with the disruptions that took place during the lockdown continuing to have a ripple effect.

“Some disruptions affect us directly, others affect our customers. If a customer cannot complete an engine build because they are waiting on parts, they will slow down the rest of the supply chain,” Reason says. “We are seeing an impact from our customers because of their supply chain challenges, and we can be part of that problem if we do not have the supply chain we need. So, we look for alternate supply sources where we can, introducing flexibility for production floors to pivot our workforce when necessary to work on the jobs we do have material for.”

With strategies in place for Barnes’s staffing, supply chain, and future growth, the company is firmly on course to achieve its growth targets.

“Our vision is for Barnes Aerospace to be a $5 billion business in its core market, a goal he seeks to achieve through investing in both organic and inorganic growth. We are making significant investments in adding more capabilities and greater capacity to support the ramp-up taking place across the aerospace industry. We will continue looking to invest as the market grows, keeping an eye out for the next mergers and acquisitions opportunity to fit our core strategy.”