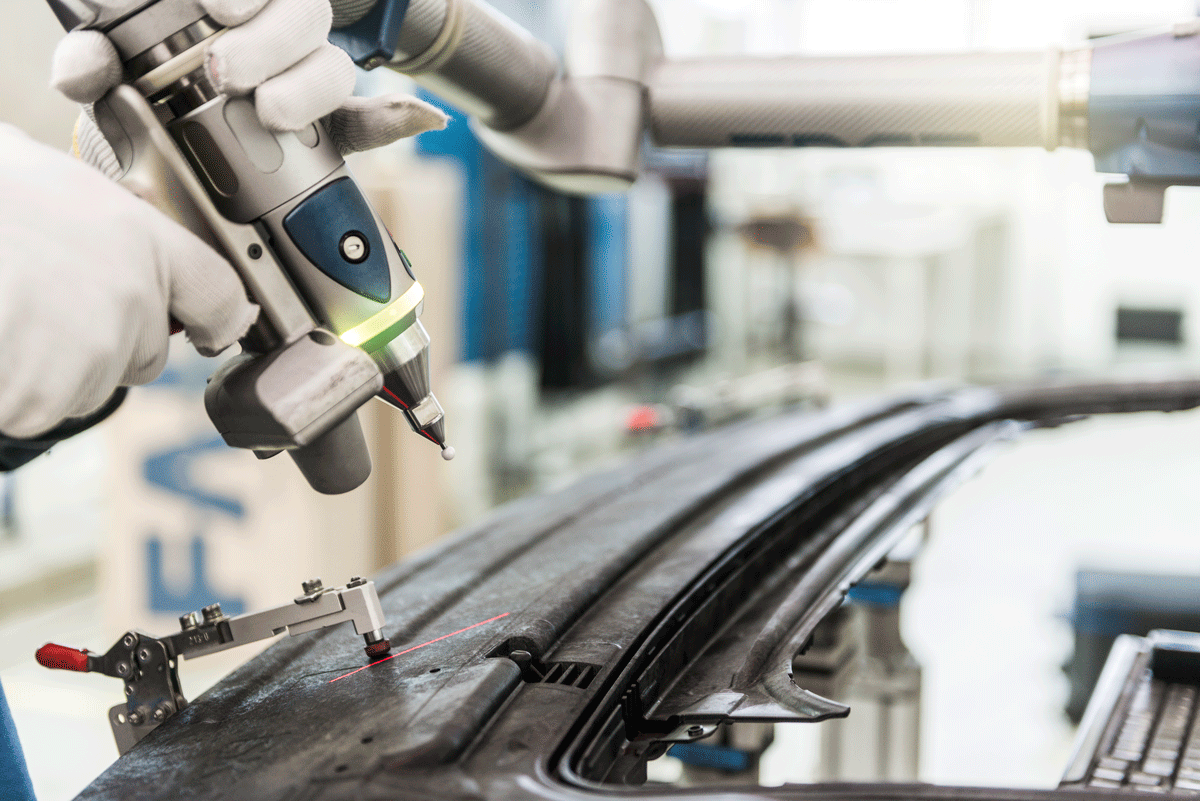

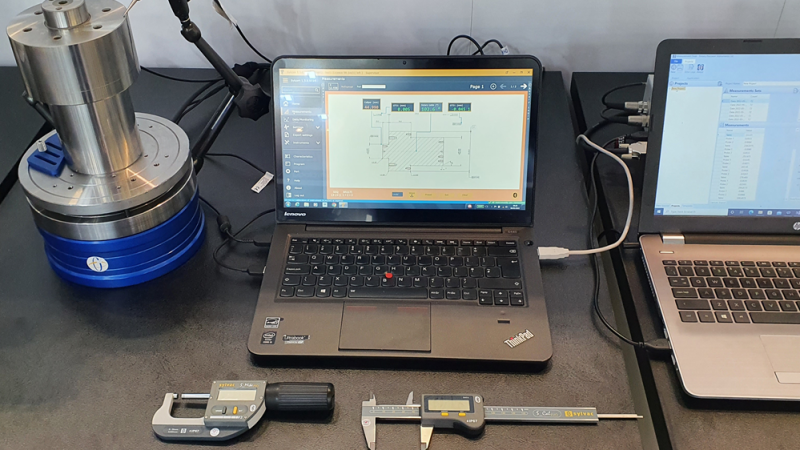

WHS Plastics is a Hi-Tech plastic injection moulder, painter, assembler, and toolmaker operating in the UK from world-class facilities in Minworth and Runcorn and complimented by its sister company WHS Plastics in Cairo, Egypt. It has established itself as a tier-one supplier to leading names in the automotive manufacturing sector, as well as the hygiene, electronics, and industrial markets.

When we last spoke with WHS Plastics, we learned how the company was able to operate successfully in a highly competitive global market, achieving an annual revenue in excess of £50 million and building a reputation for itself thanks to a winning, in-house combination of skills and expertise in design, prototyping, toolmaking, injection moulding, painting, and automation. It provides a true ‘One Stop Shop’ solution that can be tailored to the exact requirements of its customers.

That was three years ago. It has been an eventful three years. WHS Plastics has navigated the macro challenges of Brexit, Covid, a cost-of-living crisis and more. But WHS Plastics has managed to overcome each of these challenges in turn, before moving on to the biggest transformation in the company’s history.

Eight months ago, WHS Plastics acquired its largest competitor, Xandor Plastics. Not only that but given that this competitor was more than twice WHS Plastics’ size, the company effectively tripled in size overnight.

“It was almost a reverse takeover,” says Paul Nicholson, CEO of WHS Plastics.

The acquisition was in response to a process of consolidation and structural change across the industry.

“Both our competitor and ourselves were serving various OEMs including Jaguar Land Rover, and it was clear that they were planning to decrease the number of cars they built as they began to prioritise the higher-end portion of the market,” Nicholson recalls. “I concluded there was not going to be enough work for both companies, so strategically we needed to be the last man standing. The way to do that was to take over the nearest competitor.”

A Merging of Cultures

A Merging of Cultures

An acquisition can be challenging at the best of times, particularly when it comes to ensuring a smooth transition between company cultures. That situation is only magnified when the acquiring company is half the size of the acquisition.

“It’s been interesting and there are many different perspectives involved because we now have seven plants, six in the UK and one in Egypt,” Nicholson says. “But at our heart, we are still a fourth-generation, family-owned company. We were founded 91 years ago by the current chairman’s grandfather.”

For the many staff of the former Xandor Plastics, it is quite a change in pace from their previous incarnation of latterly a German venture capitalist and prior to that a Swedish conglomerate. To help with that adjustment and assist all team members in integrating within the new combined business, we centralised all administrative operations to Minworth, the traditional home of the WHS business.

“It almost looks like we are the ones that have been taken over!” Nicholson jokes. “But if you go to our individual plants, you can see how we are now trying to find the best balance between the corporate structure and the family feel of WHS Plastics.”

Showing Staff You Care

At the same time WHS Plastics was going through this acquisition, the sector was yet again facing a structural challenge in the form of a semiconductor shortage which itself was directly attributable to the previous pandemic.

“Even though the sales volumes were technically there, our three main customers couldn’t build the vehicles they wanted to and had orders for,” Nicholson recalls. “We had shutdowns and short time working and had no option but to manage costs in line with revenue. If you have budgeted for a million pounds worth of work and end up with only four hundred thousand, that creates a very big challenge.”

It would have been a challenging situation under normal trading conditions, but at a time when revenue could potentially halve from one week to the next, and then double the week after, WHS Plastics also had to ensure it retained the skills necessary to do its work.

“People intrinsically know when there is no work for them,” Nicholson tells us. “Management can underestimate their shop floor team members at times like that, and they can understandably start voting with their feet.”

Unfortunately, WHS Plastics did lose some of its experienced staff but has invested heavily in retaining core skills and attracting new talent. The company has embarked on a huge employee engagement program.

“We look at what people are worried about, issues such as the cost of living and mental health,” Nicholson tells us. “We offer free half-hour clinics from financial advisors, mental health and wellbeing support, free fruit and vend Fridays. These are the small things you can offer to the entire workforce without a high cost to the business. There will always be someone offering 50p an hour more, so it is about making sure our people know the company cares about them.”

A Company for the Future

A Company for the Future

For now, Nicholson’s focus is on completing the integration of WHS Plastics and Xandor Plastics, and then to move onto the next challenge facing the industry.

“In line with the development of the UK EV market various customers are launching over the next 18 months various new models including the all-electric Range Rover so we’re preparing for that in earnest,” Nicholson says. “Across various customers we have a billion pounds worth of booked orders in the pipeline, so now we are ensuring we put the right product in the right place with the right skills and investment.”

Ultimately, WHS Plastics’ acquisition of its former competitor has made both companies stronger.

“Before we competed with each other as competitors, now we can look at the best in class across both businesses and make sure that we set up a manufacturing footprint that is sustainable in terms of business, profit and CO2 footprint,” Nicholson says.

The last item is only going to increase in importance. The automotive sector is changing forever, and the bottom line all comes down to sustainability.

“With the acquisition, we now have a plant in Scotland with its own wind turbine and biomass fuel generators. So, we are looking at the benefits of that,” Nicholson says. “We use clear benchmarking processes because our plants are directly comparable in terms of what they do and how many people they employ.”

In particular, Nicholson talks about the way WHS Plastics is looking at compressed air usage and how to reduce its cost. As a plastics processor, material recycling is also a major priority.

“Plastics in general can have a negative reputation particularly due to single-use products, so we are working with our customers to increase the recycled content on a product and application basis,” Nicholson tells us.

As Nicholson’s products are in many instances made to their customers’ designs and specifications, cooperation is essential. But if there is one thing that WHS Plastic has demonstrated over the last year, it is that it knows the value of cooperation and how to quickly adapt to changes in both the market and the sector.