Hall & Pickles stands as the oldest general steel stockholder in the UK, and probably the world. Yet throughout the company’s long life, it has remained firmly rooted in the Northwest.

The story of Hall & Pickles General Steel Stockholders begins in 1812. A family-owned business, the company grew to become a PLC in the 1960s, trading under the name Hall Engineering Holdings. By the 1990s the company fell back into family ownership again, becoming Hall & Pickles 1812 Ltd, a holding company that included not just Hall & Pickles itself, but its additional acquisition of John Tainton.

Today that business is still family-owned, run by two brothers, Matthew and Alex Hall. A traditional family business in a strong financial position, Hall & Pickles trades from four separate sites, the group head office, Hall & Pickles, Poynton, Monkhouse and Brown in Gateshead, Hall & Pickles Wombourne, the West Midlands Division, and Hall & Pickles Cross Keys, the firm’s South Wales depot.

“We supply all over the UK and Ireland,” Matthew Hall, Group Managing Director of the firm, tells us. “We source 80% of our steel from within the UK, predominantly through Tata as one of their biggest independent customers outside of the automotive sector.”

A Tale of Two Businesses

A Tale of Two Businesses

The two businesses under the Hall & Pickles banner meet the needs of two very different markets within the steel sector.

John Tainton’s business is to de coil up to 25-ton coils of metal into 2-ton packs. The company is orientated to provide standard sizes with fast throughput supported by high stock levels – a market that can be vulnerable to market forces.

“It is difficult, because you are essentially selling the same product as everyone else on the market. Service is absolutely key,” Hall says. “That means we can take an order on Monday and deliver on a Tuesday, if not the same day.”

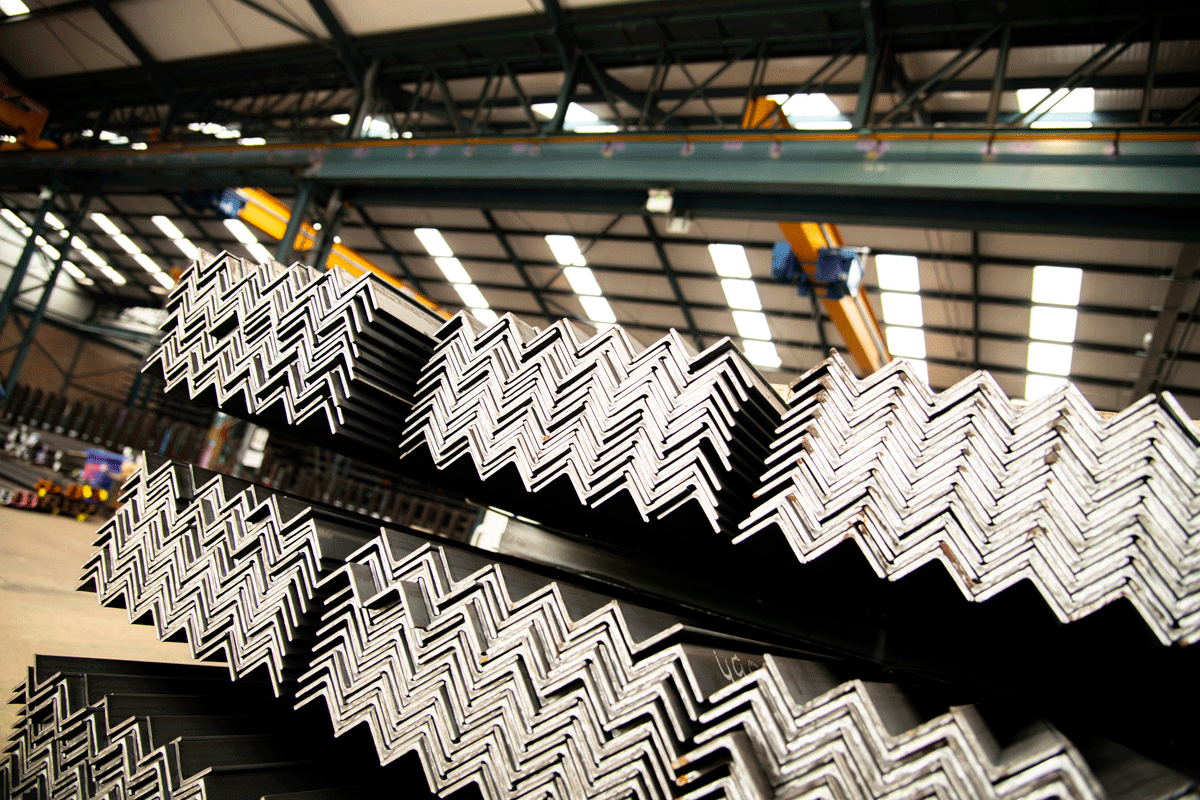

On the other side of the business, Hall & Pickles General Steel Stockholders provides a slightly different offering, a multidivisional company with a full range of products at its disposal.

“Here we add as much value as we possibly can,” Hall explains. “We are a first-line manufacturer to all areas of the UK, and our forte is service and delivery. We offer a fast turnaround that includes metal that can be cut, shotblasted, drilled, punched, lasered, painted or drilled. Pretty much anything you can do to steel without actually making a product.”

The company is a supplier operating at the highest levels in their sector, serving big-name companies in the yellow goods sector, providing not only steel materials but full turnkey solutions that can help customers reduce their working capital and support them with reliable just-in-time service to whatever products they are making.

“Service is essential here as well, obviously, but we are also providing solutions to the manufacturing sector,” Hall explains. “If a customer has an issue or production problems, we can take that out of their hands, sort the issue ourselves and deliver the product back to the customer on time to a just-in-time schedule.

The Time for Just-in-Time

These days just-in-time delivery is a phrase you hear less often in most sectors. While a few years ago it seemed to be the basis of the entire manufacturing industry, the Covid pandemic and ensuing supply chain issues have led many businesses to view just-in-time as a significant risk.

“With bigger manufacturers, sourcing from all over the world, it hasn’t always worked,” Hall points out.

However, Hall adds that steel is a different proposition entirely. It is bulky, meaning it takes up space, and much like time, space is money.

“Most of our customers just want the steel to turn up on time, working on a very short-term basis,” Hall says. “We are talking delivery next day, or within the next ten days maximum. Not all of our customers are large-scale. Many are small fabrication firms that do not want to be sitting on steel. They want it to turn up as they need it, then ship it out. That is what we offer.”

Greener Steel

Greener Steel

But while that need for just-in-time delivery is still in place, the market is changing in other ways, and Hall & Pickles is changing to meet it. In short, Hall & Pickles is getting greener.

“We are all looking to progress along the green steel journey,” Hall says. “We want to reduce our carbon footprint, so we are adding solar to all our sites. We have also just refurbished all our offices to top-end specifications, while also reroofing our warehouses with better insulation for energy efficiency.”

The firm’s fleet is being continuously renewed to find the lowest possible emissions, and its already existing policy of sourcing steel from as close to home as possible keeps it ahead of potential new tariffs on foreign steel.

On top of that, Hall & Pickle’s biggest supplier, Tata Steel, is currently preparing to close both of its blast furnaces in Port Talbot, replacing them with an electric furnace that will process recycled steel. It is a bold change, but one which could cause potential supply chain challenges.

“It will take five years to do, and when it is complete it won’t be able to produce the same product range,” Hall says. “The time scale is a worry because there will be a transition period, during which time they will ship steel in from their Indian plant to put through the UK market.”

If Hall & Pickles is forced to supplement that with metal from elsewhere, it means entering a whole new sector for the company.

“Then you are into trading steel, which means putting more working capital into the business, taking more risk because the steel price can move unpredictably,” Hall says.

Fortunately, it is a challenge that Hall & Pickles is well-positioned to meet thanks to its strong balance sheet.

“We can afford to tie up capital in the business, we are on a growth curve at the moment, but it still means adapting to the market quickly,” Hall says. “Most importantly, you have to make sure you have the right suppliers. That is how we stay ahead of the game.”

And Hall & Pickles is in a good position to stay ahead of the game. Regardless of the challenges ahead, Hall & Pickles’ growth trajectory means they are looking to adapt and expand.

A little while ago a carpet factory next to the John Tainton site burned down, leaving the site as little more than a patch of open concrete.

“That is perfect for us,” Hall says. “It gives us the ability to stock and hold more steel should the market go that way, and even put in another de coiling line to extend our coverage to the heavy end of the plate market.”

The other big plan Hall & Pickles has for the future is, quite simply, lasers.

“We have put two new lasers in, and we are applying for planning permission to put in a purpose-built laser facility that can potentially house four more,” Hall says. “That’s the plan going forward.”

With the latest equipment, growing capacity, and the ability to respond quickly to changing markets, Hall & Pickle’s 200-year-long history is just the start.