Harnessing vital internal capabilities, Cirtek engages with high technology companies in the United States, Europe, and Asia. The company exhibits strategic vertical integration allowing the group to maintain a highly diversified technology and product portfolio, enabling Cirtek to maintain key exposure in various semiconductor growth segments; these include RF & communications, System in Package, chiplets, industrial devices, power management, and various sensing devices.

Cirtek’s primary product, semiconductors, also known as chips, are found in a multitude of devices from electric vehicles, data centres, computing devices, smartphones, aerospace applications, and various industrial devices. With technology becoming more entrenched in humanity’s evolution, the role that semiconductors play in our everyday lives will only develop further.

Many businesses have experienced large economic waves that influenced industries significantly in recent years. Many of these served as a massive shakeout to key players, testing each and every one’s mettle and resiliency, while certain economic catalysts like geopolitics and technology protectionism served as tailwinds, leading the semiconductor industry to a position that exudes resiliency and differentiation from more traditional businesses.

resiliency and differentiation from more traditional businesses.

Seeing this, Brian Liu, the group CEO has taken the necessary steps in the past years to strategically position and prepare the company to capitalize on this renaissance in the semiconductor industry. Brian navigating the ship away from mature and traditional sectors and shifting the group’s focus into their semiconductor arm has resulted to Cirtek’s ability to weather out various economic shakeouts that allowed the Group to remain resilient during the Covid-19 pandemic, Russia-Ukraine war, supply chain bottlenecks, and the chip shortage.

Well-suited to meet new demand.

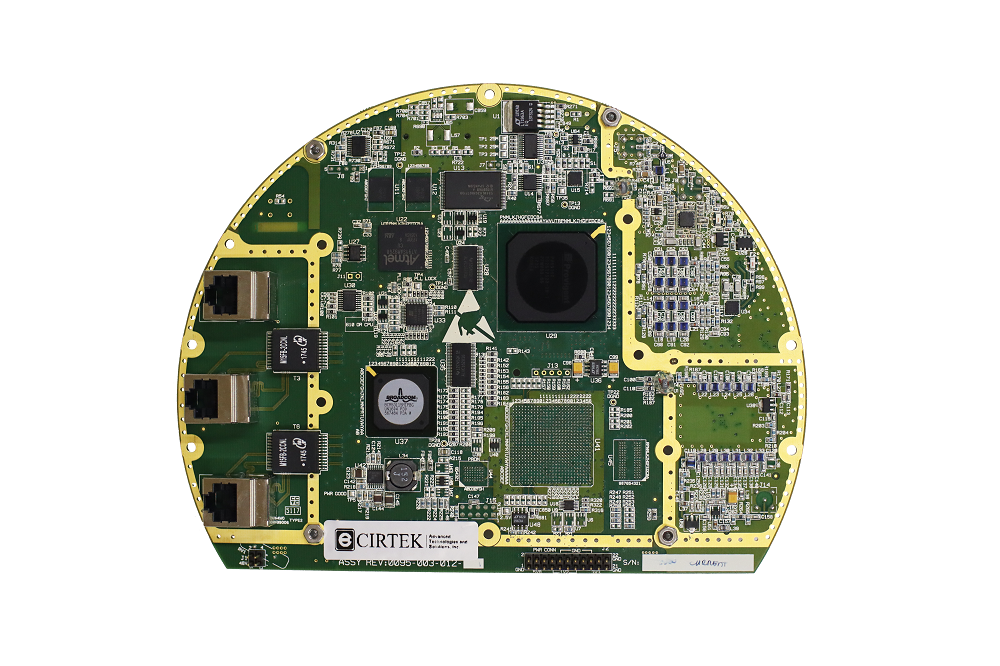

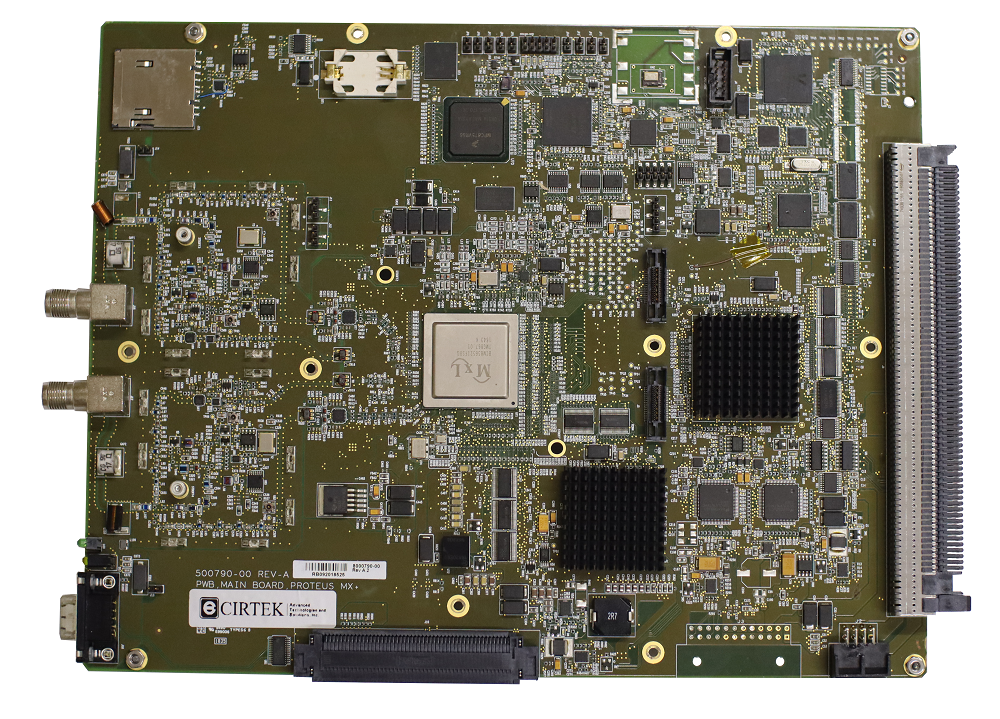

Cirtek engages in design activities in the United States but assembles and tests all their semiconductor devices at its manufacturing complex located on a 22,296 square meter facility within the Philippine Economic Zone Authority (PEZA) export industrial park inside Laguna Technopark, one of the most progressive and developed industrial parks in the country.

“One of Cirtek’s key strengths is in custom-made and application-specific devices or ASICs, which gives the company a competitive advantage, and significantly contributes to its resilience against individual segment fluctuations. The bespoke nature of Cirtek’s chipsets is also one of the factors that makes the company well-suited to meet the demand from new growing sectors such as AI.”

As such, Cirtek, with its 1,500 talented employees, is ready to embrace the new developments. Brian noted that over the last year, Cirtek’s positioning in the 5G and communications segment through its RF and communication chipsets has enabled the company to experience positive exposure to new markets.

“The establishment of 5G across the world has allowed for faster data transmission speeds, and much more efficient communication between machines, enterprises, and human beings,” he pointed out. “This proliferation of 5G has to a certain extent served as a pivotal point in opening the floodgates to a whole new ecosystem, which is AI.”

“5G created the necessary backbone and infrastructure required in order to have stable artificial intelligence applied in items that we use in our daily lives. A few years back, 5G created a lot of new devices needing chipsets for that application. And we expect the same thing to occur with this new AI trend. This has been one of the key developments over the past year, and we have reflected that in our business.”

Again, Cirtek’s diversification will play to the company’s strengths. “We don’t focus on one device family. Rather, we maintain a diversified technology portfolio in terms of exposure in order to ensure proper risk mitigation. Our bespoke approach also allows us to be ready for the new products that are very custom in nature.”

Again, Cirtek’s diversification will play to the company’s strengths. “We don’t focus on one device family. Rather, we maintain a diversified technology portfolio in terms of exposure in order to ensure proper risk mitigation. Our bespoke approach also allows us to be ready for the new products that are very custom in nature.”

Brian further noted that like the semiconductor industry, the space of artificial intelligence is broad and has multiple layers. “It’s not just all about the application-specific ICS. We are also delving into the areas around it that can serve as a complement. We are looking at areas such as image and sound recognition chips, as well as connectivity chips, such as RF and communication chipsets. All these are considered complementary to AI emergence, enabling AI applications. This is something we focus on as further diversification. ”

Best performing industry

As more devices and aspects of our daily lives become electrified and digitised, demand for semiconductors is set to rise. Gartner’s sector analysis states that global semiconductor revenue is projected to grow 16.8% in 2024 to total $624 billion, and according to Morgan Stanley, a base-case estimate for growth for the AI semiconductor industry is at 36% between 2023 and 2027.

This favourable outlook means new opportunities for Cirtek. “Within AI there’s a cut between two categories – the general purpose one, which includes GPUs (graphic processing units)and FPGAs (field programmable gate arrays), and custom AI, which are ASICs – application specific IC chipsets, SIPs and SOCs,” explains Brian, affirming that Cirtek is positioned to serve the custom AI semiconductor space which will tend to stay resilient in economic downturn.

“The semiconductor industry is one of the best performing industries in the world, mainly because of the resilience that the role of semiconductors plays in our everyday lives. The very pillar that comprises innovation and technology in itself is none other than the chips that power it. So, we are going into a period of renaissance in this industry. And I think that we have the prospect of good tailwinds that will last for some time.”

He reflected that despite increasing demand, Cirtek is not planning to expand by means of acquisitions and buyouts. “I prefer a more conservative approach, focused more on the exploration of joint ventures and strategic partnerships. With our existing client base, it would not be very difficult to jumpstart that expansion. That is something that is definitely on the horizon.”