Supriya Lifescience Ltd was established in 1987 by Dr Satish Wagh, a first-generation entrepreneur. Today it is one of the leading global API manufacturers catering to key therapies like antihistamines, anti-allergenics, anti-asthmatics and more.

“We started producing at low volumes, but saw global potential in our products,” explains Dr Saloni Wagh, the company’s Whole Time Director. “We decided to focus on travelling the world, learning to understand those global markets, and registering our products there. We are now the largest manufacturers of antihistamine products around the world.”

Supriya Lifescience started out with only very small production volumes of around 500kg a month, but today its volumes approach levels of 50,000kg a month – more than all its rival manufacturers put together.

However, these volumes are crucial for Supriya’s efforts to meet the demand of an international market. Supriya has been export-orientated since its inception, and even today 80% of the company’s $70 million revenue is from export markets. In particular, 45% of those markets are highly regulated, such as the USA, Europe, Canada, and Latin America.

“These are the core markets we operate in,” Dr Saloni tells us. “We are present in more than 100 countries, with a customer base of 1,200 customers including multinational household names such as Johnson & Johnson and GlaxoSmithKline.”

A Global Reach

A Global Reach

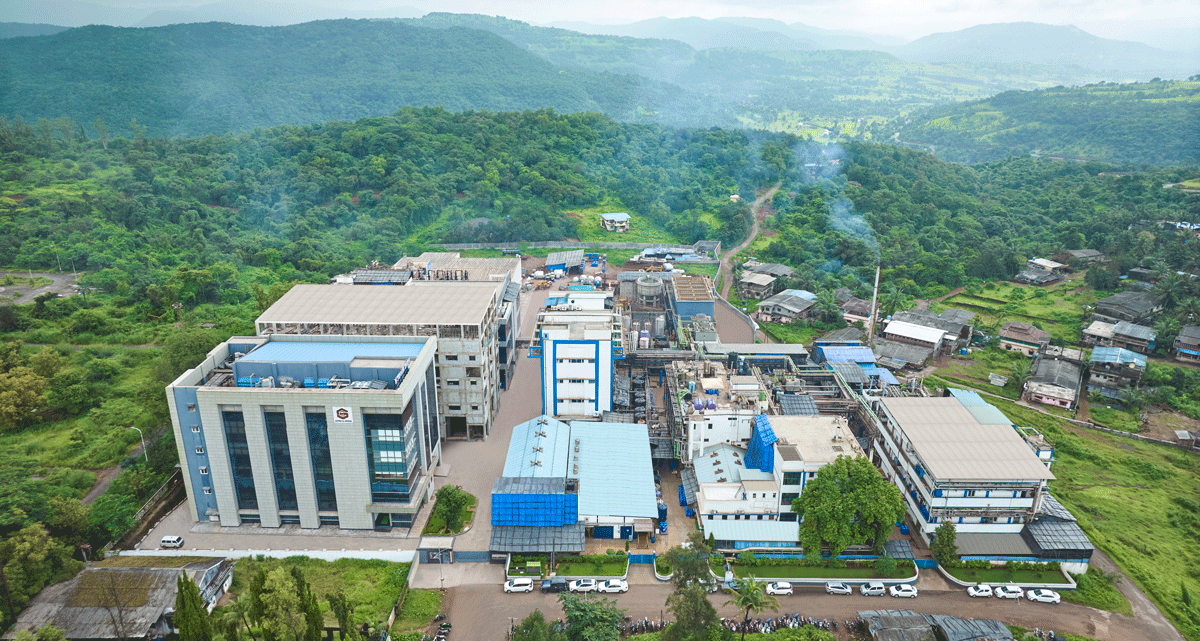

To ensure its products can meet those high regulatory thresholds, Supriya’s facilities are built to the highest standards. The company’s Mumbai HQ and its manufacturing site 250km away are US FDA-approved, alongside 35 other regulatory authorities like NMPA China, Health Canada, and EDQM, among others.

“Regulatory compliance is a key focus area,” Dr Saloni insists.

It is a key part of Supriya’s competitive edge, alongside the leadership position of its three primary products that contribute 45% of the company’s revenue, supported by the firm’s back-integrated business model and the scale of its operations.

“We are at the cusp of an attractive growth phase marked by profitable growth that enhances value in the hands of all those associated with our company,” Dr Saloni says.

In further expanding that global reach, Supriya recently signed a collaborative agreement with US-based firm, Plasma Nutrition. This patented technology has been developed as a delivery system for optimised proteins.

“You can pass a normal protein through their machine and get an optimised variation,” Dr Saloni explains. “With this, a reduced quantity of protein can give the same benefit along with better absorption and lesser side-effects.”

This is a revolutionary technology for the protein space, and Supriya Lifescience is the exclusive provider of it in India. The Indian protein market is valued at $1.2 billion.

Maintaining Standards

Supriya must not only maintain regulatory compliance across national boundaries but also remain compliant across time – and the regulations that Supriya needs to conform to are constantly changing and being updated.

“The regulatory environment, particularly the requirements for API manufacturers, are becoming more stringent,” Dr Saloni points out. “Each country has its own specifications and regulatory barriers, and the environment has changed drastically in the last few years. The limits are becoming more strictly defined, and audits are becoming more regular often with shorter notices.”

API manufacturing is a very dynamic, continuously changing industry, so to succeed in that sector Supriya Lifescience must adapt very quickly.

To make things more challenging, many companies across the sector are currently facing supply chain challenges. The importance of strict regulatory adherence makes the supply chain even more delicate – it is not enough for a manufacturer to adhere to international standards. Every provider along its supply chain must adhere to those standards as well. Fortunately, Supriya has found a way to protect itself from these risks.

“Major API companies face supply chain issues because they rely on imports from other countries,” Dr Saloni says. “But thanks to our backward integrated model we do not face those problems.”

Supported by that backward integrated supply chain, Supriya is well-positioned to seek out new CMO opportunities, and the firm is aggressively upgrading its facilities to achieve the highest levels of compliance.

Growing Culture

Growing Culture

As part of that process, Supriya has spent the last five years focusing on professionalising the organisation. In 2020 the firm became a listed company with a new CFO and CEO.

“I feel it is important to have our people in cross-functional teams with the right kind of technical knowledge,” says Dr Saloni. “Over the last three to four years we have been building up that technical knowledge, working to find the right talent.”

Recruiting that talent can be a challenge, as Supriya Life Science’s manufacturing units tend to be positioned in remote locations, but the company has been able to overcome that thanks to a robust management structure and strong Research and Development processes.

“Over the next three years, we want to double our top line while maintaining the 30% margin,” Dr Saloni tells us. “We are able to maintain that margin profile thanks to our backwards integrated model and our scale of operations. We want to include more products in our portfolio, we are working on newer therapies like anti-anxiety, antidepressants, anti-diabetic, and other key categories in the near future.”

At the same time, Supriya is working on multiple long-term collaborations similar to its partnership with Plasma Nutrition, and Dr Saloni hints at an important deal with a large European company.

“We are looking at new CMO opportunities, and continuously focus on new molecules,” Dr Saloni says. “Growth comes from accessing different markets while our existing portfolio has good volume growth. Even our old products are growing year-on-year.”

With a forward-looking strategy and a backward-integrated supply chain, Supriya Lifescience Ltd is well-positioned to achieve great things.