Red Sky Energy might not look like much at first glance. That is not to say it is not a strong company. It is an ASX-listed oil and gas company with a market cap of $32 million, no debt, owned by some 6,500 shareholders, primarily high-net-worth individuals, with the top 20 of those shareholders owning 22% of the shares. But it is also a small company, led by a board of only three people, even if those people bring a wealth of industry experience to the table.

“Robert Annells, our chairman, is an industry veteran with over 30 years of experience in the public upstream oil and gas sector,” says Andrew Knox, Executive Director at Red Sky Energy, who himself has more than 35 years of experience in the upstream oil and gas sectors of Australasia, Southeast Asia, and North America. “Then we have Adrien Wing, the company secretary and experienced in public listings.”

The lean senior management team is made up of Knox and Serge Toulekima, a petroleum engineer who joined Red Sky Energy in 2020 to head up new developments.

It is a small leadership team, by design, with Knox based at the company’s head office in Melbourne, Toulekima operating out of Perth and two managers operating out of South Australia, with assets in that state.

“We’re a very lean team with a three-man board and four staff, so we use contractors quite a bit,” Knox says. “It helps us to manage cash flow and be able to turn projects on and off when you need them. Currently, we are now in production and looking to hire more staff. With a lot of growth opportunities on the horizon, we will need more hands on deck. There are projects we are looking at to grow the business.”

Finding Value Others Might Miss

Finding Value Others Might Miss

Being a small team comes with advantages.

“As a small, nimble player we can seek out opportunities where others haven’t been able to do so,” Knox says. “A lot of the time we are looking at assets the big players don’t want to know about, but we can move quickly on them.”

It makes Red Sky Energy easy to underestimate, especially in terms of its assets and ability to extract value from them.

“We are undervalued, there is no question there. But we are also able to deliver,” Knox says. “We acquired these assets at very reasonable prices and then bring those into production and monetisation.”

When we speak with Knox, Red Sky Energy is undergoing a transition, having acquired a collection of assets that are full of potential, the company is finally bringing those assets into production.

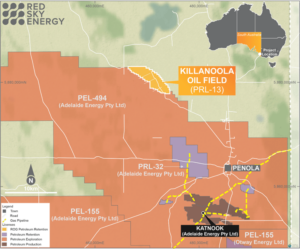

“Our main assets are in the state of South Australia in the Otway Basin. We have six licenses in the Cooper basin and have farmed out to Santos 80% of those licenses in return for a free carry through a work programme,” Knox tells us. “Down in the Southeast, we have PRL 13 licence covering a 17.5 square kilometre area that includes a 100%-owned oil field, Killanoola. We recently signed a contract for the sale of that crude oil.”

The Killanoola field, which Red Sky Energy acquired relatively cheaply and conducted a 3D seismic acquisition over last year, is estimated to hold approximately 135 million barrels of oil, of which Red Sky Energy estimates it will extract in excess of 30 million barrels, valued at in comparison to the company’s market capitalisation at just one Australian dollar per barrel in the ground.

“That is pretty compelling value in anyone’s estimation,” Knox tells us.

Red Sky Energy’s lean structure and flexibility mean it can move rapidly.

“We find we can turn things around very quickly, working 26 hours a day to get something done,” Knox insists. “We can turn something around in a day where others might take weeks. That is an advantage of being a small player.”

Entering Production

Entering Production

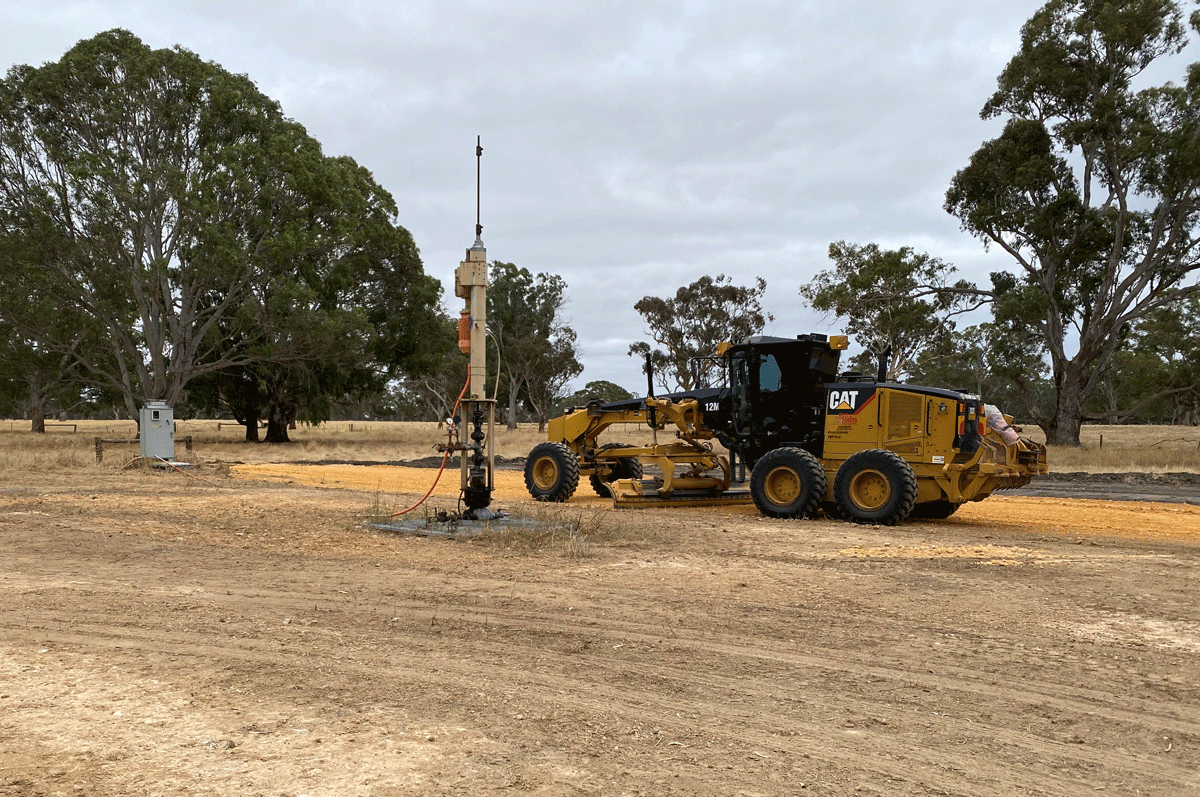

When we speak with Knox, the company is tooling up, and preparing for the next phase of its journey.

“We are in that transition phase from explorer to developer to a producer,” Knox says. “It is a wonderful position to be in, to finally have cash flow.”

Currently, the firm is in the process of well planning on the Killanola field in the year ahead. But while these resources have potential, they also come with challenges.

“The crude itself is quite waxy, it’s paraffinic, and hence has a high pour point which can make it a bit difficult to flow,” Knox explains. “But we have addressed this by working with an additive that is used elsewhere for flow assurance. We can inject that into the line at the wellhead, and that will make it easier to truck it down to the refinery, four hours away.”

Red Sky Energy has commissioned twin-skinned tanks with heating systems to ensure there are no issues with the pour point of the crude, and with these solutions in place, production is planned to start next month.

“Late last year we drilled the Yarrow 3 well, very successfully, and on the back of that well we began field development, building an 18-kilometre line to the southwest to get it into the production grid for processing and onward sale,” Knox says. “In addition, the Flax field next door has been developed previously with six vertical wells and has produced 180,000 barrels before it was shut in 2015 and we are looking to bring that back into production.”

Bigger Things

Knox points to Yarrow as an example of the monetisation that is starting to be achieved.

“Just look at what we have been able to do,” Knox says. “We have brought the Yarrow 3 well from discovery late last year to putting a pipeline in by July, and now we are in production. In the hydrocarbon business that is a quick turnaround.”

As well as being able to develop promising assets at speed, Red Sky Energy’s size also has benefits in the regulatory space.

“On the East Coast, the government has initiated a gas price cap at 12 dollars a gigajoule. As a small producer, we are not restricted by that, so we will be selling our gas at a more profitable margin,” says Knox.

Knox also foresees a profitable market niche for Red Sky Energy at a time when many larger contenders are looking to divest assets. “We have a watching brief on these.”

“As majors divest their hydrocarbon assets and move into renewables this has created a lot of opportunities,” he says. “Not just domestic opportunities, but overseas as well.”

Red Sky Energy has achieved a lot, but Knox sees this only as a foundation to continue building on.

“We have begun to deliver on what we have acquired. Even at these levels we are significantly undervalued, but we see a lot of upside in the projects we are looking at and expect also to deliver continued impressive organic growth,” he says. “We have already begun to show what we can do with our existing asset portfolio.”