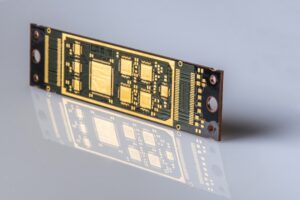

Based in Switzerland, Dyconex AG has earned a solid reputation for being a technology leader and the partner of choice for providing advanced flex, rigid-flex and rigid ultra-HDI/microvia circuit boards, interconnect solutions for miniaturization, biocompatible substrates based on LCP and chip packaging substrate solutions – all tailored to customers’ requirements.

The company, a member of the MST Group, has its roots in a division founded in 1964 within Oerlikon-Contraves. It has been operating as Dyconex since a management buy-out in 1991. As one of the true pioneers in the industry, Dyconex has continuously applied the latest technology in order to derive innovative technologies for various markets.

The company, a member of the MST Group, has its roots in a division founded in 1964 within Oerlikon-Contraves. It has been operating as Dyconex since a management buy-out in 1991. As one of the true pioneers in the industry, Dyconex has continuously applied the latest technology in order to derive innovative technologies for various markets.

With its traditional strong focus on high-end, high-reliability markets, Dyconex remains at the forefront of PCB development. The company is the world’s leading manufacturer of highly reliable PCBs for the medical industry, especially for medical implants. Biocompatible interconnect solutions are also one of the company’s strengths. In addition, the company produces rigid and rigid-flex substrates for various other industries.

Successful year

We spoke to the company in 2021 and came back to see how it stands in the post-pandemic environment. At that time, Dyconex was commemorating its 30th anniversary – an important milestone which, due to the pandemic restrictions, could not be celebrated in style.

However, Dyconex’s performance over the last year was the best testament to its legacy and a confirmation of its continued position at the forefront of the industry. Dr Hubert Zimmermann, Dyconex CEO, affirms that the company made significant technical progress in the area of packaging substrates and LCP, with >20 layers and 18µm L/S, and also implemented the first superconducting PCB for supercomputing applications.

“We had been involved in these segments for several years, but the culmination point came in 2022. Overall, we have really pushed some important technology-driven projects with several large players that are expected to ramp up in 2023.”

Business development has been supported by investment in technology. The company is based in Bassersdorf, near the Zurich-Kloten airport, with facilities spread over more than 6,000 m2, of which 600 m2 is a Class 10,000 clean room. In 2022 Dyconex acquired a new electroplating line and Orbotech AOS (a repair machine for very high-end one space applications) and has also accomplished the refurbishment of wet chemistry and full tracing of PCB production.

“Last year we did a lot of research and prototyping and now the task is to turn these highly complex prototypes into volume manufacturing. To comply with extremely challenging customer projects and at the same time maintain series production is a challenge that we are facing right now.”

Sustainable partnerships

As for any European business, sustainability is a hot topic for Dyconex. Christian Beck, the Head of Sales, explains that sustainability is viewed within the wider context of Dyconex and includes both environmental and business aspects.

“We are on the way to ISO 14001 certification to demonstrate our efforts with regard to sustainability and have initiated numerous projects to reduce our carbon footprint. From the business point of view, Dyconex is always aiming for a long-term customer relationship.”

“Prototyping is always done with a view to building sustainable partnerships with our customers. With most of them, we have had relationships lasting decades, and these partnerships will drive the business in 2023 and beyond.”

He points out that while 2022 was pretty much a year of hard work by the R&D and application engineering departments on prototyping, the results of which have been successfully submitted to clients, the company is now expecting these projects to ramp up, promoting further growth. “Doing a high-end prototype is one thing but converting that into volume business is a wholly different ballgame. We would not be engaged in this process without the perspective of long-term partnerships.”

Technology of tomorrow

Dr Zimmermann notes that Dyconex is monitoring market trends closely. “We see a strong interest in packaging/IC-substrates, fostered by some reshoring and tight capacities in Asia. Miniaturization was a strong market driver in the past and will remain so also in the future. There is also significant interest from catheter manufacturers in using PCB technology to lower manufacturing costs.”

“Implanted medical devices such as pacemakers and defibrillators as well as ultrasound diagnostics and hearing aids are segments where we have been active for many years. Here, one of the key market drivers is miniaturization. This is what all the OEMs are after – miniaturization without compromising on quality and reliability.”

He further points out that in addition to Dyconex’s home turf markets, i.e. implants, ultrasound and hearing aids, smart catheters can be observed as an emerging market in the medical field. “Bringing the PCB advantage into catheter applications will allow for significant cost savings, especially on whatever has wires in it,” he remarks, adding that this will present very attractive business opportunities for Dyconex.

Ready to expand

To offset increasing cost pressures in the medical industry, passed down to the suppliers, the company is looking at further automation. “Switzerland may be known for cheese, watches and chocolate but certainly not for low labour costs,” reflects Dr Zimmermann. “Therefore, we need to apply our labour wisely, for those parts of the process where manual handling cannot be replaced, where it brings value to customers. In all the others, automation comes into play.”

Overall, Dyconex is well placed to face the future. As explained by the director, the company has some very promising R&D projects and once these come close to series production, the company is set to expand capacity. “Our annual growth rate is currently forecast at about 7%. Our facilities in Switzerland are limited. Once our projects materialise, we will be in a position to expand into other countries and to other sites,” concludes Dr Zimmermann.